Take out a piece of paper and write down your average Customer Lifetime Value (LTV). If there is a number now staring back at you, awesome! Go ahead and jump to the section on “5 Ways You Can Profit from it”. If not, you still have a nice, clean sheet of paper you can use to make a paper airplane.

Better yet, this short guide will show you how to calculate and profit from this important number.

The Short Answer:

Customer Lifetime Value is a prediction of the future net profit over the entire relationship with a customer (including their referrals).

5 Ways You Can Profit from Customer Lifetime Value (LTV)?

If you think of your business in transactional terms, you will end up making short-term decisions that are less profitable in the long-term. Would you rather make a single profitable sale today or multiple profitable sales in the future?

- Which acquisition sources are most effective? By comparing the LTV of customers acquired through different acquisition sources you can determine which are the most profitable. Sources can include target audiences, marketing channel and even offer. So instead of focusing on which acquisition strategy generated the highest net response rate, focus on which ones produced the greatest ROI.

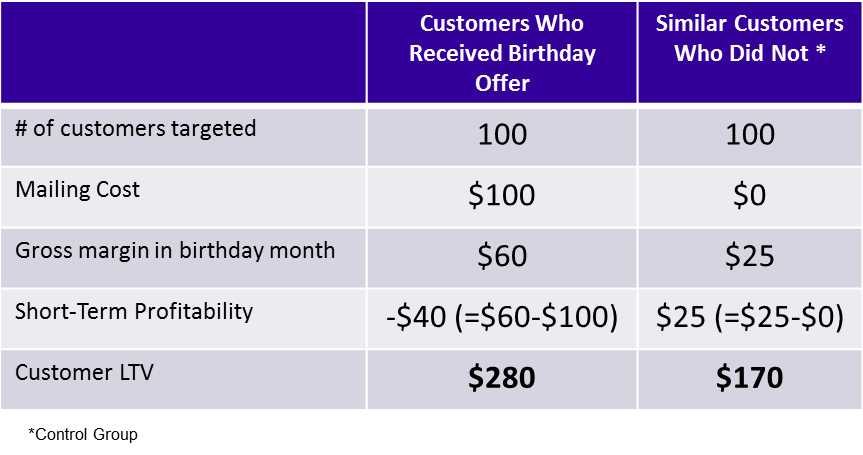

- Which customer marketing strategies are most effective? Rather than take a tactical approach to cross-sell and up-sell marketing efforts, using lifetime value you can be much more profitable. Suppose, for example, a shoe store sent a birthday card to all its customers with a discount offer to purchase shoes in their birthday month. As you can see from this example, the birthday promotion was a bust in the short-term since it lost money. But if you look at the lifetime value of the promotion, it was very profitable.

- How much should you spend to acquire a new customer? A Referral? Suppose you know that the LTV of a new customer is $500 and you need a 25% ROI. Then, theoretically, you can afford to spend up to $400 (=$500/125%) to acquire that customer. If your ROI window is shorter (e.g. 6 months), then you would use the 6-month LTV to determine your acquisition cost. To determine how much you can afford to spend to acquire a referred customer, you would use a similar calculation.

- How much should you spend to retain an existing customer? Suppose you had two customers who are about to close their accounts. Customer “A” has an LTV of $4,000 and Customer “B” has an LTV of $160. Knowing this, you can tailor you retention offers based on their future value. From a proactive standpoint you are better off investing in retention programs for Customer “A” than “B”.

- Who are your best customers? It is very common for elite frequent flyers to have their own customer service number. They are privy to flight upgrades, exit row seating and advance boarding privileges. When there is a flight delay, they are taken care of first (in theory at least). By letting your front-line employees know which customers are more valuable, they will have the information they need to know how to treat them accordingly.

The Short Answer:

| Lifetime Value = | [Average Value of a Sale] | |

| x | [# of Purchases per Year] | |

| x | [# of Years Customer Is Active] | |

| + | [Value of Referrals] |

An example would be the lifetime value of a dry cleaning customer who spends $10 every visit, drops her clothes off 3 times per month and does so for 2 years with a gross margin of 60%. The value of that customer would be $10/visit x 3 visits/month x 24 months x 60% gross margin ≈ $430 lifetime value.

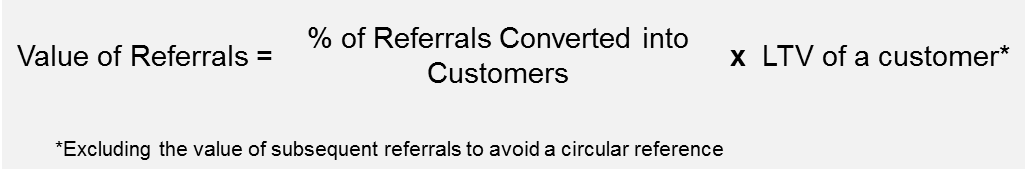

But what about referrals? … In addition to the direct profit, your customer also provides 3 referrals of which on average 50% convert into customers. That brings her total value to $645 (≈ $430 initial customer + $430 * 50% conversion into a referred customer). Should you include acquisition costs in your LTV calculation? No. The value of a new customer is based on the profitability they will generate for you once they are acquired. The acquisition cost is very important in determining whether a particular method of acquiring that customer provides an acceptable return on investment (ROI) and should be done in a separate calculation. Close your eyes and think of a pool ball (your new customer) rolling on a pool table. (Okay, this isn’t going to work. Keep your eyes open so you can read the rest of this and then close your eyes and do the imagining thing). If you do nothing to the ball, you can predict where it will end up (its lifetime value). Now also imagine a cue ball (e.g. customer cross-sell promotion) rolling on the table and hitting the pool ball (your customer) at some point. The pool ball will end up in a different location (different LTV) than if it was not hit. I’m sure this has happened to you many times — You close a multi-million dollar deal in the fourth quarter to much accolades. The following quarter, however, even though you are 40% behind quota, your boss tells you not to worry since you did such a great job last year. Anybody? Since not all customers are created equally, an average LTV will mask the potential of some while overinflate it for others. Suppose, for example, that customers acquired through internet searches were more profitable over the long-run than those acquired through referrals. In this case you would want to have a different LTV for each acquisition source. Your ability to calculate LTV will depend on how far back you have transaction data. If your data only goes back 2 years, then your definition of LTV can be at most 2 years, since you do not know how they will perform after that. Since the LTV is based on a set of future cash flows (i.e. purchases) from the customer, a more accurate LTV calculation would discount those cash flows using Net Present Value.

So, the Future LTV changes from where the pool ball originally would have ended up to where it would end up after being hit by the cue ball. In other words, every time you implement a new customer marketing program or acquire different types of customers, your forecasts will become less and less accurate.

Well, the “What have you done for me lately?” mentality doesn’t just apply to employees, it also applies to customers. While the LTV is normally calculated for new customers, a separate LTV can be calculated at every stage of a customer’s life cycle. The importance of this will be more relevant when we talk about retention and how we treat our “best” (a.k.a. most profitable) customers.

Another consideration is how you compare the LTV of existing customers. To do so you need to normalize for the amount of time from when they were acquired. For example, if you wanted to compare the LTV of customers acquired 3 years ago with those acquired 2 years ago, the former group most likely would appear more profitable; they would have an extra year of purchases.